Here’s a typical conversation I (James) have as a tax advisor:

Client: "James, how do I lower my tax liability? I’m a higher rate taxpayer and my income is taxed at source via payroll.”

James: Increase your pension contributions?

Client A: “I’m 30, I don’t want to lock away funds for 25/30 years.”

OR

Client B: “I’m close to the lifetime allowance.”

OR

Client C: “I’ve used up my annual allowances.”

James: “Have you heard of EIS investments?”

EIS investments are Enterprise Investment Schemes. They are designed to let companies raise money in order to grow their business. As an individual investor, you can therefore buy shares in these companies and in return receive tax reliefs. However, rather than list the tax rules that apply to EIS investments, this case study might help you understand it better.

Jim is a Scottish software developer earning c£60k annually as an employee.

As things stand, Jim’s income after tax looks like this:

|

Gross Income |

£60,000 |

|

Income Tax |

(£13,080) |

|

National Insurance |

(£5,079) |

|

Net Income |

£41,841 |

My first suggestion would be to increase the pension contributions, but Jim is happy with the level of his contributions.

Jim has done some research and with the help of his Independent Financial Advisor (IFA) he has identified three small UK companies which qualify for EIS tax relief, and he has purchased shares in each company:

· 10,000 x £1 shares (£10,000) in Biomed Ltd.

· 10,000 x £1 shares (£10,000) in Green Energy Ltd.

· 10,000 x £1 shares (£10,000) in Fintech Ltd.

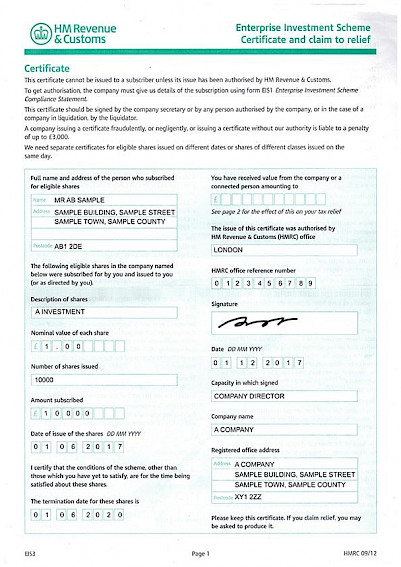

After a few months, Jim receives an EIS3 certificate (see below) for each investment from HMRC.

At this point, the income tax relief can be claimed either using the form or through a tax return.

As Jim’s tax advisor, I can help him claim 30% of the investment from each company as a “tax reduction”. This would be 30% of £30,000 (£9,000).

Jim would then get a tax repayment from HMRC of £9,000 directly into his bank account. After three years, he could sell them all back and keep the tax repayment he received.

However, if he sold them within three years, this would prompt HMRC to claw back the repayment.

Most people know about this tax relief, but let’s take it a bit further.

It’s now three years down the line, and the initial £30,000 investment looks like this:

· Biomed Ltd. has failed and the 10,000 shares are now worthless

· Green Energy Ltd. has also failed, again the 10,000 shares are worthless

· Fintech Ltd. has done well and the 10,000 shares are now worth £20,000

As the tax advisor, this is now my time to shine!

Although the portfolio has done very well, further tax relief can be claimed on Biomed Ltd and Green Energy Ltd despite the businesses failing.

In most circumstances, a loss on an investment can only be claimed against capital gains. However, EIS investments are different, they can be claimed against income if the taxpayer chooses. Not only that, there is flexibility in the timing of claiming the income tax relief too. You could carry the loss back into the previous tax year if the income tax rate was higher.

Let me show you how I would claim it in this case:

I could claim the full £14,000 as a deduction against Jim’s income in the tax year of the loss. This would save him £5,740 (41% of £14,000).

If Jim was an English taxpayer, it may have been better to claim £7,000 in one year and £7,000 in the previous tax year to ensure the full higher rate tax relief is claimed.

I would analyse the best result on Jim’s behalf.

Here is the result of Jim's investment after three years:

|

Money initially invested in EIS |

£30,000 |

|

|

Initial tax repayment from EIS (30% £30,000) |

£9,000 |

|

|

Repayment of failed companies |

|

|

|

Total tax repayment received (£9,000 + £5,740) |

(£14,740) |

|

|

Total Cost of EIS |

£15,260 |

Jim spent £30,000 to buy shares in three companies. He received a tax repayment from HMRC of £14,740.

The total cost to Jim was £15,260 (£30,000 minus £9,000 income tax repayment minus £14,740 income tax repayment). Here's an overview:

|

Total Share Purchases |

£30,000 |

|

Income Tax Repayment (30%) |

(£9,000) |

|

Income Tax Repayment from company failure |

(£5,740) |

|

Total Cost |

£15,260 |

Jim’s EIS portfolio is now worth £20,000.

There are further tax breaks for having EIS shares, i.e. capital gains tax deferral relief, disposal relief, and IHT relief. However, we’ll leave these for another day.

EIS shares offer many tax advantages, but they are high-risk companies. At Anderson and Edwards, we recommend that you speak to an IFA before investing in anything. What's better, speak to a tax advisor AND a financial advisor in tandem to be fully aware of your investment options.

Considering Enterprise Investment Schemes to reduce your tax liabilities? Don't hesitate to speak to us about it, even if it's to ask a question. Email me at Enable JavaScript to view protected content. or call us on 0131 364 4191.

© 2024 Anderson & Edwards Ltd|Registered in Scotland SC678768|Privacy Policy|Website by Broxden