The Westminster Government have voted for the proposal to increase taxation. These will become effective in 2022. Make sure you are aware of these and the implications they will have on you and your business before it happens.

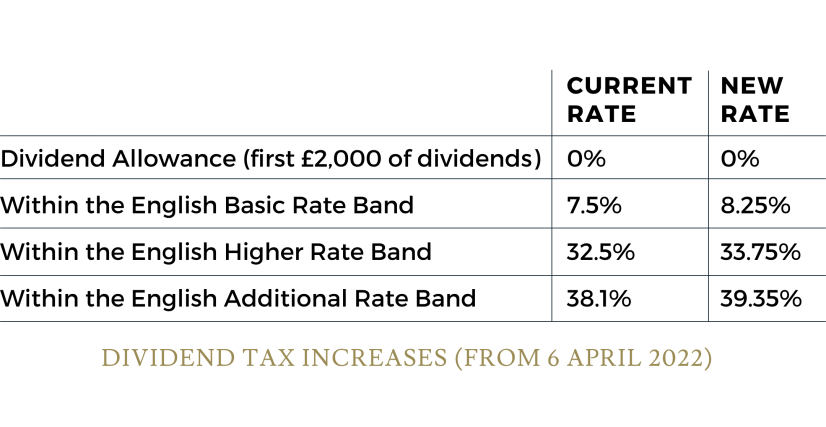

Here's what the tax rates will look like from 6 April 2022.

This change will take effect on 6 April 2022.

The rates will then revert to the current rates on 6 April 2023, and a new tax will be introduced of 1.25% called the social care levy. This will effectively bring the rates back up to the new higher rates, with one exception:

People who have reached state pension age do not pay national insurance, even if they still have employment income. However, they will not be exempt from the social care levy as it will not technically be a national insurance contribution.

The changes won't stop there though. In 2023, a new tax of 1.25% will be introduced - the 'Health and Social Care Levy'. This will effectively bring the rates back up to the new higher rates, with one exception: People who have reached state pension age will not pay National Insurance, even if they still have employment income.

However, they will not be exempt from the Health and Social Care Levy as it will not technically be a National Insurance contribution.

As an employee, the first step would be to ensure your pension contributions are as efficient as possible.

Only employer’s contributions receive National Insurance relief. Therefore, negotiating with your employer to increase their contributions (to the maximum 5%), while you make a 0% pension contribution AND take a reduced salary, could benefit you and your employer (this would be a salary sacrifice).

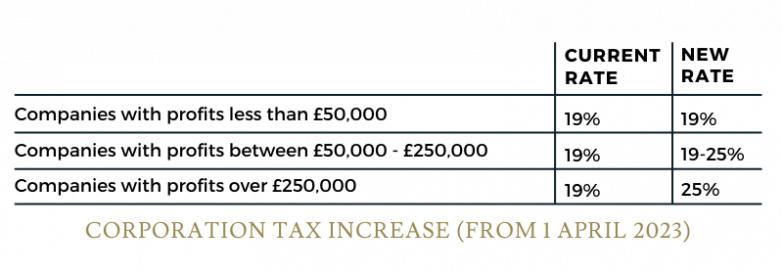

As a business owner, a limited company could offer you greater flexibility in how you take profits. The interaction between your National Insurance liability, your taxable company profits, and the level of dividends taken will be more complicated than ever. The employment allowance (currently £4,000) will also be more important than ever.

No matter what situation you are in, take time to assess how the tax increase will impact you (and your business).

We like to think we're not your normal tax advisors or business accountants. But we will let you be the judge of that. If you want to find out for yourself, give us a ring on +44 (0) 131 364 4191 or email Enable JavaScript to view protected content..

© 2024 Anderson & Edwards Ltd|Registered in Scotland SC678768|Privacy Policy|Website by Broxden